Revenue Recognition for High-Volume Businesses

Complex revenue streams can become a labyrinth for accounting teams. Effortlessly navigate through it with Numeral.

Spreadsheet-Level Flexibility.

Database-Level Scalability.

Numeral can handle any rev rec logic at scale. All this without having to worry about spreadsheets crashing due to high-volume.

Default

GAAP-compliant revenue recognition rules for common use cases.

Custom

Custom rev rec logic based on your businesses unique needs.

Effortlessly Handle All Revenue Accounting Complexity

Accounting done in real-time upon each transaction and financially relevant event.

- Deferred

- Usage-Based

- Milestone-Based

- Effective Interest Rate

- Gift Cards

- Discounts

- Credits

- Refunds

- Chargebacks

- Upgrades

- Downgrades

- Pauses

- Cancelations

- Multi-Element Arrangements

- Standalone Selling Price

- Reallocation

- Multiple Performance Obligations

And Much More.

ASC 606: The Most Common Use Case Automated with Numeral Revenue Recognition.

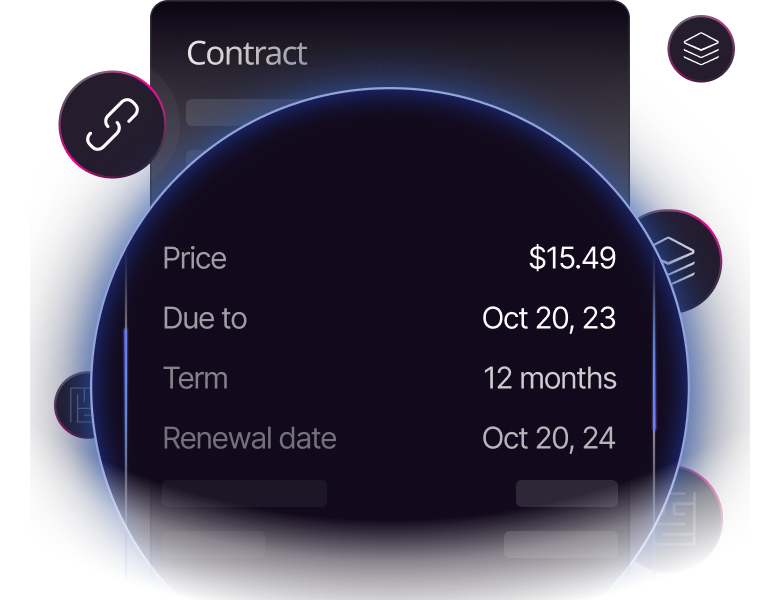

Identifying Customer Contracts

Contract details identified from all billing and order management systems.

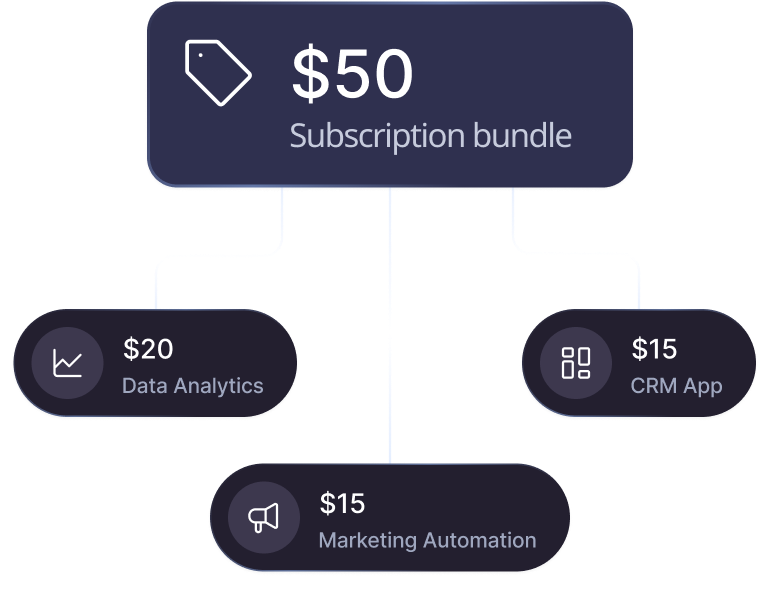

Highlighting Performance Obligations

Line items identified and converted into clearly defined performance obligations.

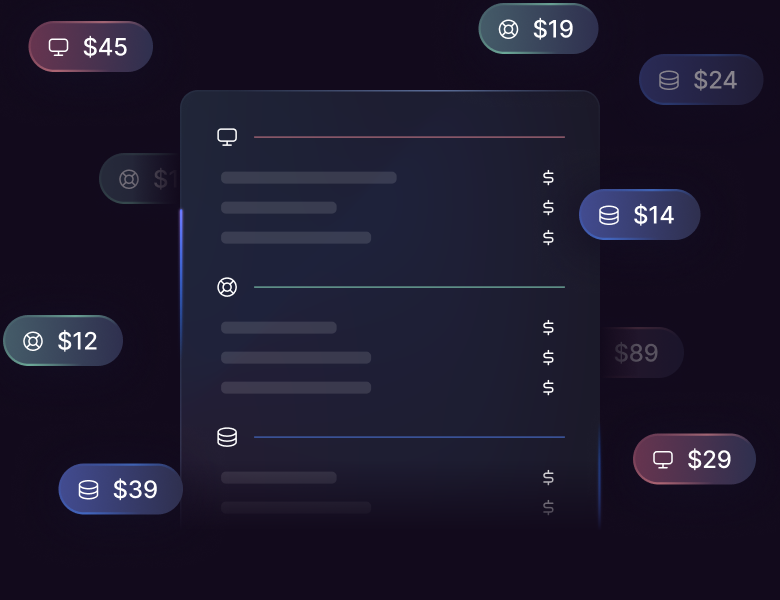

Determining Transaction Prices

Transaction prices determined from payment processors.

Allocating Transaction Prices

Transaction prices from price list allocated to each performance obligation.

Recognize Revenue

Revenue recognized in real-time upon each transaction and financially-relevant event.

Features

Complementary to General Ledgers

Lock periods and export summary journal entries into your general ledger.

Scale Your Revenue Reporting.

Ready for a paradigm shift in your revenue recognition process?